How to Legally Avoid Car Sales Tax

This Could Save You a Ton of Money

If you’re like me, you don’t enjoy paying taxes.

I understand that taxes are sometimes necessary, but at times, they can be burdensome.

I live in the San Francisco Bay Area, where sales tax (paid to the California DMV) when registering a new car is about 9.25%.

It would be really cool to not have to pay an additional 4, 5, or even 6 figures on top of the money I already paid the car dealer.

How to Avoid Paying Car Sales Tax

Montana residents and businesses enjoy no sales tax on cars (or other licensed vehicles like motorcycles, boats, RV/motorhomes, etc.)

“But I don’t live in Montana” you tell me.

Yes, but you can own a business that is based in Montana.

For example, I (a California resident) can form a company in Montana. I can have my new Montana company purchase a vehicle and register it in Montana. And then, I can drive the company vehicle wherever I want.

There are companies (Montana registered agents or attorneys) that can help you with forming the Montana company (you don’t need a Montana address if you work with a Montana registered agent) and doing the Montana DMV paperwork. They’ll even go to the Montana DMV office on your behalf to submit your papers and mail you your new Montana car registration and license plates.

In step form:

- Form a Montana company, with the paperwork that the registered agent or attorney supplies you.

- You can then purchase a vehicle as the Montana company.

- You (or the car dealer) mail the vehicle’s title to the registered agent or attorney.

- The registered agent or attorney walks into a Montana DMV office on your behalf to register the vehicle.

- The registered agent or attorney mails you the new Montana registration.

I won’t recommend any specific company that offers registered agent or attorney services, but if you search Google for “Montana LLC Car Registration”, a ton of results will pop up.

Costs

Initial Costs

It’s not expensive to form a Montana company. Additionally, Montana DMV fees for initially registering vehicles are low.

In total, initial costs are approximately $849.

Yearly Costs

It’s relatively cheap to maintain a Montana company. And again, Montana DMV fees are low.

The cool thing about Montana is that if the vehicle is over 10 years old, the vehicle can be permanently registered. So there’s no need for annual registration renewal, annual vehicle inspections, etc. That’s right, if the vehicle is over 10 years old, there are no DMV fees.

In total, yearly costs are approximately $49 (if the vehicle is over 10 years old) or $139 to $269 (if the vehicle is 10 years old or newer).

Does This Actually Save Money?

Probably.

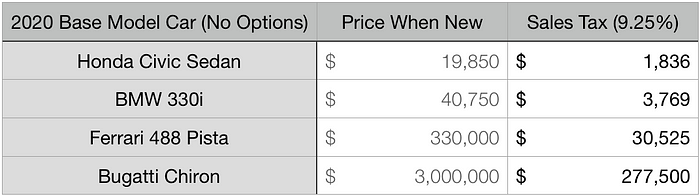

I’ll explain by giving you four examples. I’ve calculated the initial and yearly costs for registering cars in four different price ranges in the San Francisco Bay Area and Montana.

The four cars are 2020 base models (with no options):

- Honda Civic,

- BMW 3-Series,

- Ferrari 488 Pista, and

- Bugatti Chiron.

“Normal people” can stand to benefit about $1,000 to $5,000 in initial sales tax and registration fees, and $150 to $500 a year in registration renewal fees.

“Well-off people” benefit the most, saving about $20,000 to $300,000 in initial sales tax and registration fees, and $800+ per year in registration renewal fees. This is why it’s not uncommon to see supercars with Montana license plates.

Additionally, after the first 10 years of ownership, the yearly savings will increase by $90 to $220 due to Montana’s permanent vehicle registration after 10 years.

Most people who do this will save money.

But Should You Do This?

The money aspect checks out. But should you do this?

Definitions

Before we begin this discussion, we need to define some terms.

Tax avoidance is “the use of legal methods to modify an individual’s financial situation to lower the amount of income tax owed. This is generally accomplished by claiming the permissible deductions and credits.” (Investopedia)

Examples of legal ways of reducing your taxes include things like putting money in 401(k) or IRA retirement accounts, giving charitable donations, or paying for university tuition. Additional examples of reducing taxes is qualifying business expenses.

Tax evasion is “an illegal activity in which a person or entity deliberately avoids paying a true tax liability. Those caught evading taxes are generally subject to criminal charges and substantial penalties.” (Investopedia)

Examples of illegal ways of reducing your taxes include underreporting your income, or just straight up not paying the taxes.

In summary: tax avoidance is legal, tax evasion is not.

Montana Legalities

It is legal to form a business in Montana, provided that the business has an address in Montana where you can be served/mailed papers and other legal documents. By using a Montana registered agent or attorney, they allow your business to use their Montana address. It doesn’t matter who owns the business.

According to Montana law (MCA 61–3–311), all Montana vehicles do not have sales tax.

Legalities of Your State

You’ll need to check your state’s laws for cars with out-of-state registration.

For example, in California, an out-of-state individual (not a permanent California resident) may drive their out-of-state registered car in California, for not more than 30 consecutive days. (AAA) There is nothing stopping this individual from having the car in California for 29 days, driving the car to Nevada for a day trip, and then bringing the car back to California the next day to stay for another 29 days.

Some states are more lax, while some states are more restrictive. As long as you follow all the laws, you should be in the clear. But please do your own research for your state.

Cops

Vehicles with out-of-state license plates definitely get noticed more by local cops. If you get pulled over in a Montana registered car and you show them your not-Montana drivers license, they’ll definitely question you about why you don’t have a Montana drivers license or why the car isn’t registered with your state.

You’ll need to explain that it’s a company car, owned by a company that is based out of Montana. Cops may be unaware of the exact legalities of this. So again, please be sure to do your own research for your state.

Insurance

Like any other vehicle, you’ll need insurance.

When you’re setting up the insurance. You cannot add the car to your personal car insurance plan. Additionally, you cannot give them your personal home address or your personal details. You must give them your Montana company’s details. And you must tell them that you plan on primarily driving the vehicle not in Montana.

If you do not do this, the insurance company has every right to invalidate an insurance claim, if you file one.

Because the Montana company-owned car, but driven by an “out-of-state” driver situation isn’t very common, the insurance premiums might be a little bit higher.

But I think that for most people doing this, the value of the money saved from avoided sales tax and lower yearly registration renewal fees will be much more than the increase in insurance premiums.

Conclusion

There is clearly a monetary incentive to register your car in Montana. You could save thousands of dollars on up-front sales tax. Additionally, you can save hundreds of dollars per year on registration renewal fees.

The process to get this done isn’t complicated. Pretty much everything can be done online or via mail. You don’t even need to leave your home state.

But ultimately, the decision to register your car in Montana is up to you.

Further Reading?

Interested in other car things? Check out the three things I learned when I test drove a Model 3 Performance for a month:

Or here are some things you can do to make Model 3 even quieter than it already is:

Interested in money topics?

If you’d like to get your very own Tesla to try out saving on sales tax, you can get 1,000 miles of FREE Supercharger miles if you use my referral link! https://ts.la/matthew18238

Footnotes

Disclaimer: Matthew Cheung does not provide tax, legal or financial advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or financial advice. You should consult your own tax, legal and financial advisors.